North Carolina Insurance Pre-Licensing FAQs

NOTE: Unless indicated otherwise, the information below pertains to both the Life and Health Insurance Pre-Licensing Courses.

Who is required to take these courses?

Anyone wishing to obtain a North Carolina Life Insurance license or Health (Accident and Health or Sickness) Insurance license must successfully complete the appropriate course. Successfully completing the course involves going through all 20 hours of the material and passing the final exam with at least a 70% score.

Are these courses approved by the state of North Carolina?

Yes. Both the Life Insurance Pre-licensing course and the Health (Accident and Health or Sickness) Pre-licensing course have been approved by the North Carolina Department of Insurance.

Are there exemptions to taking these courses?

Yes, there are exemptions to each. However, the exemptions noted below must still sit for the state insurance examinations.

Exempt from the Life Insurance pre-licensing course:

- Certified Employee Benefits Specialist (CEBS)

- Certified Financial Planner (CFP)

- Certified Insurance Counselor (CIC)

- Holder of a degree in insurance (associate or bachelor's)

- Chartered Life Underwriter (CLU)

- Chartered Financial Consultant (ChFC)

- Life Underwriter Training Council Fellow (LUTCF)

- Fellow Life Management Institute (FLMI)

Exempt from the Accident and Health or Sickness Insurance pre-licensing course:

- Certified Employee Benefits Specialist (CEBS)

- Health Insurance Associate (HIA)

- Registered Employee Benefits Counselor (REBC)

- Registered Health Underwriter (RHU)

- Holder of a degree in insurance (associate or bachelor's)

How long are the courses?

Each course lasts 20 hours.

Can I complete this course as quickly as I want?

Due to state regulation, students will only be able to spend eight hours per calendar day on the course. Once you have used your allotted eight hours, you will be locked out and be unable to re-enter the course for another 24 hours.

What topics are covered?

The Life Insurance pre-licensing course is designed to present students with important information related to the field, including:

- Basic Principles of Life Insurance and The Insurance Industry

- Life Insurance Policies, Provisions, Options, and Riders

- Life Insurance Premiums, Proceeds, and Beneficiaries

- Life Insurance Underwriting and Policy Issue

- North Carolina Statutes and Regulations

- Etc.

The Health Insurance pre-licensing course is designed to present students with important information related to the field, including:

- Health and Accident Insurance

- Health Insurance Providers

- Medical Expense Insurance

- Accidental Death & Dismemberment Insurance

- Health Insurance Policy Provisions

- Etc.

How do these courses help me understand all of the information?

There is a lot of information to go over, and in addition to providing the material in as clear a manner as possible, there are other techniques in these courses to help you understand and retain the information. Throughout both courses, there are segments of audio narration as well as "hidden hints" that you may click in to help better understand the concepts being presented. There are also quizzes at the end of each lesson to familiarize you with the concepts from each section and help prepare you for the final exam.

Are the quizzes scored?

No. The quizzes are not used to determine whether or not you pass the exam. They are used only as an aid to help you understand the material and prepare for the final exam.

Are there any other prompts during the course?

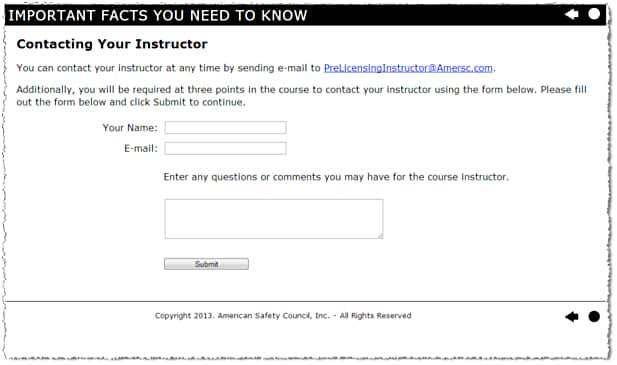

Yes. At three points in the course — in the introduction, half-way through the course, and at the end of the course — North Carolina requires that students correspond with their instructor. They will encounter the screen below. Students must enter their name, e-mail address, and a question or comment for their course instructor before moving forward in the course.

How long is the final exam?

The final exam contains 150 multiple choice questions. There is a timer set to 150 minutes (2 ½ hours), and you must complete the exam within that time frame or you will be locked out of the course.

What is the score needed to pass the final exam?

You must answer at least 70% of the questions correctly — or 105 of the 150 — in order to pass.

What if I don't pass the final exam?

You may take it again. You will have unlimited attempts to pass the final exam. You will not be able to take the state licensing exam until you have successfully passed this course.

What happens once I pass the final exam?

Upon successful completion of the course, you'll be able to download a Certificate of Completion, also called an Exam Admission Ticket.

What do I do with the Exam Admission Ticket?

You will need to take your Exam Admission Ticket with you to the testing center when you sit for the state insurance examination. This ticket is valid for 90 days after successful completion of the course or five exam attempts, whichever happens first.

What happens if I don't pass the state exam within 90 days or after 5 attempts?

Per North Carolina state regulations, if you do not pass the exam within 90 days of earning your Exam Admission Ticket or in five attempts, you must retake the pre-licensing education course before you are eligible to sit for the state exam again.

Once I complete the course, will I still have access to the content?

Yes. You will be able to review the course content at your leisure to review and prepare as much as you need for the state exam.

How do I make a reservation for my state examination?

Candidates who successfully complete this 20-hour pre-licensing course may make their reservation online by visiting the Pearson VUE website and selecting "Make an Exam Reservation".

How long is the state licensing exam?

The state examination for both the Life Insurance license and Accident and Health or Sickness Insurance license is 1 hour and 15 minutes long.

What do I do once I pass the state examination?

Once you pass the state licensing exam, you must complete an electronic application on the National Insurance Producer Registry website. If required, fingerprints must be submitted after completing the license application.